Why Consider Long-Term Care Insurance?

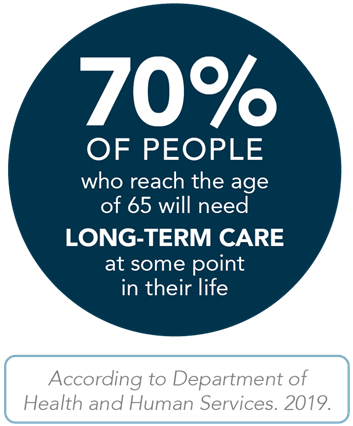

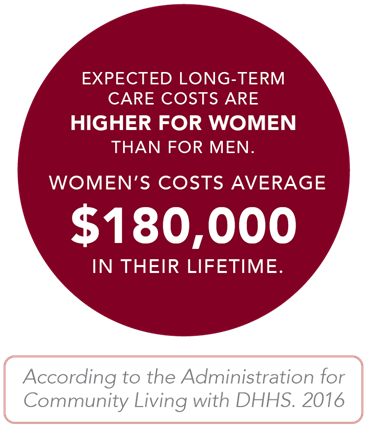

You value your freedom and independence, and you want to maintain them as long as you can. However, an unexpected accident or illness can jeopardize those things. Your health insurance policy won't cover long-term care costs and government funding falls short, as well, with only limited financial support coming from Medicaid. Plus, in order to qualify for Medicaid, you must deplete the vast majority of your assets. Are you financially prepared to cover the expenses of long-term care should you become ill or disabled, or need special medical treatment as you get older?

By choosing Long-Term Care coverage, you are helping to protect your children, your spouse, your parents, and yourself.

We reserve the right to increase the cost of this Long Term Care Rider. We will make changes only if there is a need for a new rate table. If a new rate table is used, it will apply to all individuals of the same class as your rider. A class means all riders with the same characteristics such as issue age, gender, geographic location, and effective date.

For costs and further details of this Long Term Care Rider, including exclusions and reductions or limitations, please contact your agent or Pekin Life Insurance Company at

1-800-322-0160 for a referral to an agent.

To be eligible for this Long Term Care Rider, a medical exam may be required. Issuance of this Long Term Care Rider is subject to underwriting approval.

The purpose of this communication is the solicitation of insurance. Respondents will be contacted by a Pekin Life Insurance Company agent. Home Office is in Pekin, Illinois.

ICC23-LP010

What We Offer

A Unique Look at Long-Term Care

Our Long-Term Care Rider can be attached to a qualifying Life Insurance policy. This may be a more affordable option than a traditional, stand-alone Long-Term Care policy. Adding Pekin Insurance Life Insurance Company's Long-Term Care Rider to your life insurance contract can help give you the additional financial protection you need. In the event you need long-term care, this rider can help cover qualifying long-term care costs.

Designed to help pay for Long-Term Care expenses

When there is a need for special care at adult daycare centers, assisted living centers, nursing home facilities, or even at home by giving you access to your life insurance policy's death benefit to help pay for these services.

and if you never need Long-Term Care...

Your policy's death benefit remains in place for your beneficiaries.

Here's how it works!

Our Long-Term Care Rider allows you to designate a portion of your insurance death benefit ($50,000, $100,000, or some other amount not to exceed your face amount or $500,000, whichever is less) to serve as a pool of money to pay for long-term care expenses. Once you have incurred any qualifying long-term care expenses, we will reimburse your out-of-pocket costs up to a maximum payment of $17,500 per month, up to a total payout of $500,000.

By adding Pekin Life Insurance Company's Long-Term Care Rider to your life insurance contract, you can maintain your independence while you are living and, in the event you do not require long-term care, we can help protect your family and/or business after you are gone, providing money to cover final expenses, uncovered medical and nursing costs, and estate taxes.

We reserve the right to increase the cost of this Long Term Care Rider. We will make changes only if there is a need for a new rate table. If a new rate table is used, it will apply to all individuals of the same class as your rider. A class means all riders with the same characteristics such as issue age, gender, geographic location, and effective date.

For costs and further details of this Long Term Care Rider, including exclusions and reductions or limitations, please contact your agent or Pekin Life Insurance Company at

1-800-322-0160 for a referral to an agent.

To be eligible for this Long Term Care Rider, a medical exam may be required. Issuance of this Long Term Care Rider is subject to underwriting approval.

The purpose of this communication is the solicitation of insurance. Respondents will be contacted by a Pekin Life Insurance Company agent. Home Office is in Pekin, Illinois.

ICC23-LP010

Frequently Asked Questions

-

As you draw your long-term care benefit payments from your pool of money, your death benefit and the other values are being reduced each month. Depending on how long you draw benefit payments and on what percentage you elected for your pool of money, your death benefit may eventually be eliminated. But because your estate isn't depleted to pay for your care, more of your estate will be left for your beneficiaries.

-

Yes, although your benefit would be adjusted slightly by the amount you have received due to terminal illness.

-

You can begin receiving benefit payments after 60 days of continuous care. You must be deemed chronically ill by a licensed health care practitioner, which is defined as unable to perform two or more Activities of Daily Living (ADLs) either as a result of illness, injury, advanced life, or upon diagnosis of a reduction of mental capacity.

-

Yes. We will pay benefits for Alzheimer's Disease and other brain disorders without any requirements for demonstrable organic disease.

-

You can draw up to 100% of the actual dollar amount you specified for the benefit, to a maximum benefit of $500,000 minus any policy loans and previous withdrawals.

-

Care must be provided in a long-term care facility, an adult day care center, a hospice, an assisted living facility, or at home by a home health care agency.

-

Only you can make that decision. You should remember that this rider's benefits are paid as a percentage of your life insurance death benefit and are not based on the actual costs of long-term care. These benefits will help you pay long term care expenses, but may not cover them completely. You should examine your benefits carefully before making any replacement decisions.

-

Whether or not you're liable for taxes on your long-term care benefits depends on how the IRS interprets portions of the applicable tax code. This rider is intended to be a federally tax-qualified traditional long-term care insurance contract as defined by tax code. You should talk with your tax advisor if you're concerned about the impact of taxes.

-

That depends on a number of factors, including your age, health condition, and the amount of coverage you are requesting. Most individuals find that the cost for the rider is very reasonable in relation to the overall cost of their life insurance contract.

We reserve the right to increase the cost of this Long Term Care Rider. We will make changes only if there is a need for a new rate table. If a new rate table is used, it will apply to all individuals of the same class as your rider. A class means all riders with the same characteristics such as issue age, gender, geographic location, and effective date.

For costs and further details of this Long Term Care Rider, including exclusions and reductions or limitations, please contact your agent or Pekin Life Insurance Company at

1-800-322-0160 for a referral to an agent.

To be eligible for this Long Term Care Rider, a medical exam may be required. Issuance of this Long Term Care Rider is subject to underwriting approval.

The purpose of this communication is the solicitation of insurance. Respondents will be contacted by a Pekin Life Insurance Company agent. Home Office is in Pekin, Illinois.

LP012